OPTIMIZE RECOVERIES WITH AI

MACHINE LEARNING-POWERED

Increasing collections with advanced consumer intelligence

POWERFUL IMPACT

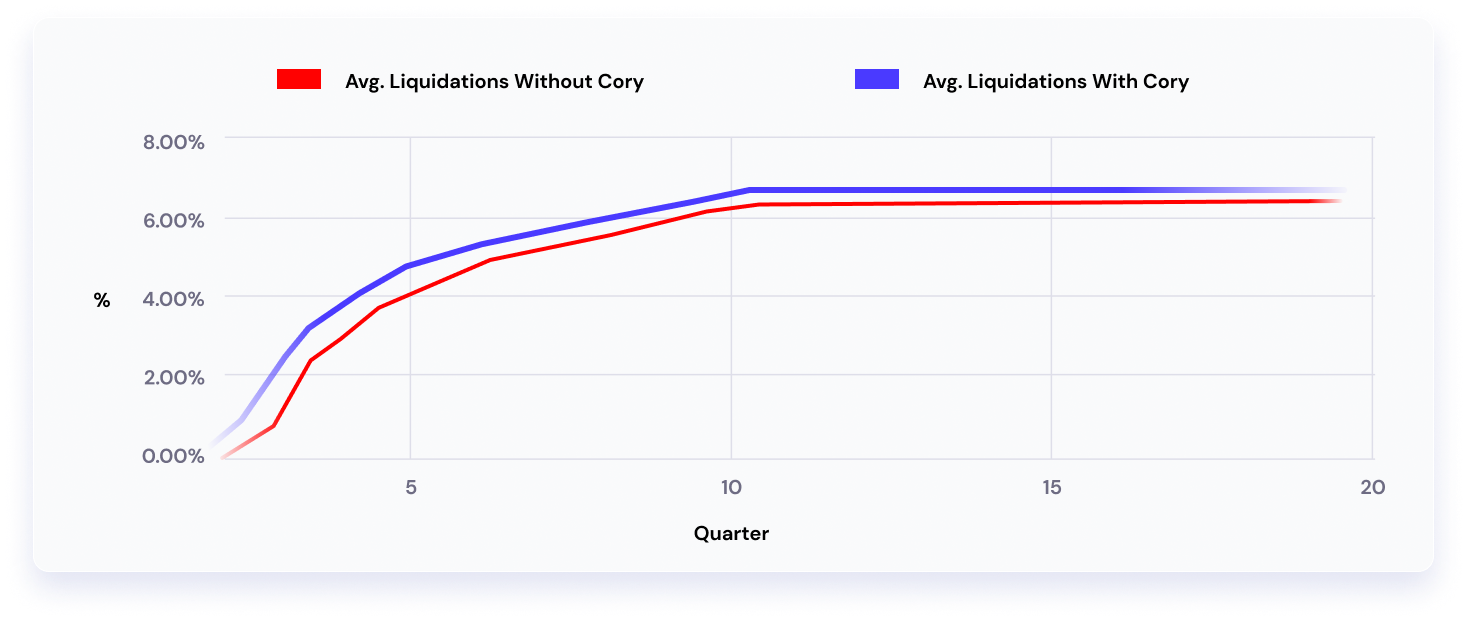

Cory identifies the 25% of receivables that account for 90% of a portfolio's revenues

| Lift agency revenues by 5% | Achieve labor cost savings of up to 11% | RoI on Cory of 3.8x |

CORY SCORE

Score accounts based on their revenue potential

Cory scores a receivable's recovery potential from 1 to 10. Scores are based on not only each account's expected top-line revenue, but also key associated costs and operational challenges. The result is a blended score that accounts both for revenue potential and propensity to pay.

Accounts with a Cory Score of 1 have the very best recovery potential and will be the bedrock of a portfolio's performance. A Cory Score of 10 indicates negligible recovery potential.

.png?width=800&height=234&name=Group%2039500%20(2).png)

CORY RECOMMENDATION

Identify the most profitable servicing strategy for each account

Alongside the Cory Score, Cory recommends individualized strategies for successfully engaging with customers. Cory determines the best form of intervention for each account, according to your operational resources and expertise. This allows for more successful outcomes with fewer outbound attempts.

A FAMILIAR AND SEAMLESS USER EXPERIENCE

Utilize Cory within your collections management platform

Easy integration

Cory can be made accessible directly via your collections platform, integrating seamlessly with your existing tools and dashboards

Automatic and ongoing

All charge-off accounts uploaded to your collections platform will be automatically processed by Cory

Minimal paperwork

Receive full access to Cory after a one-time registration process