One platform for all your data enrichment needs

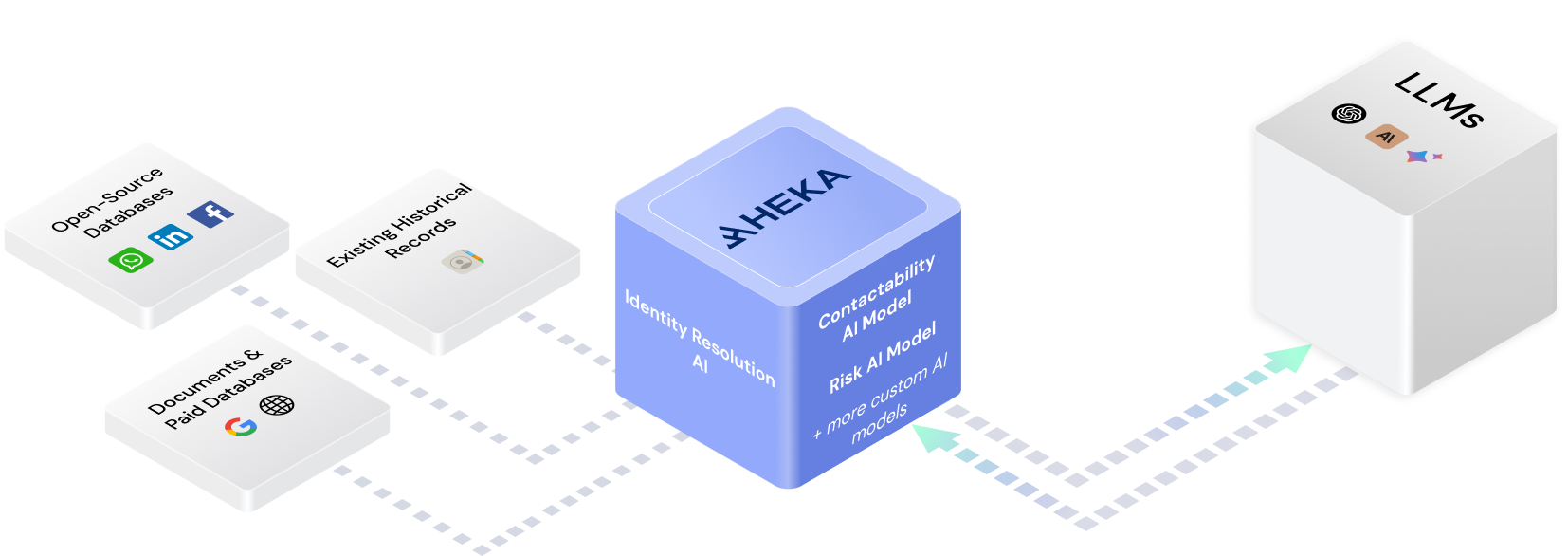

Our web intelligence platform incorporates 3+ years of model training by the ex-intel analysts and data scientists, developing an ever-improving AI analyst agent for financial services.

Access key live data that boosts the value of each customer

Our platform leverages a proprietary database of >8.5M records, web intelligence, and custom AI models, to create an ever-improving data enrichment platform

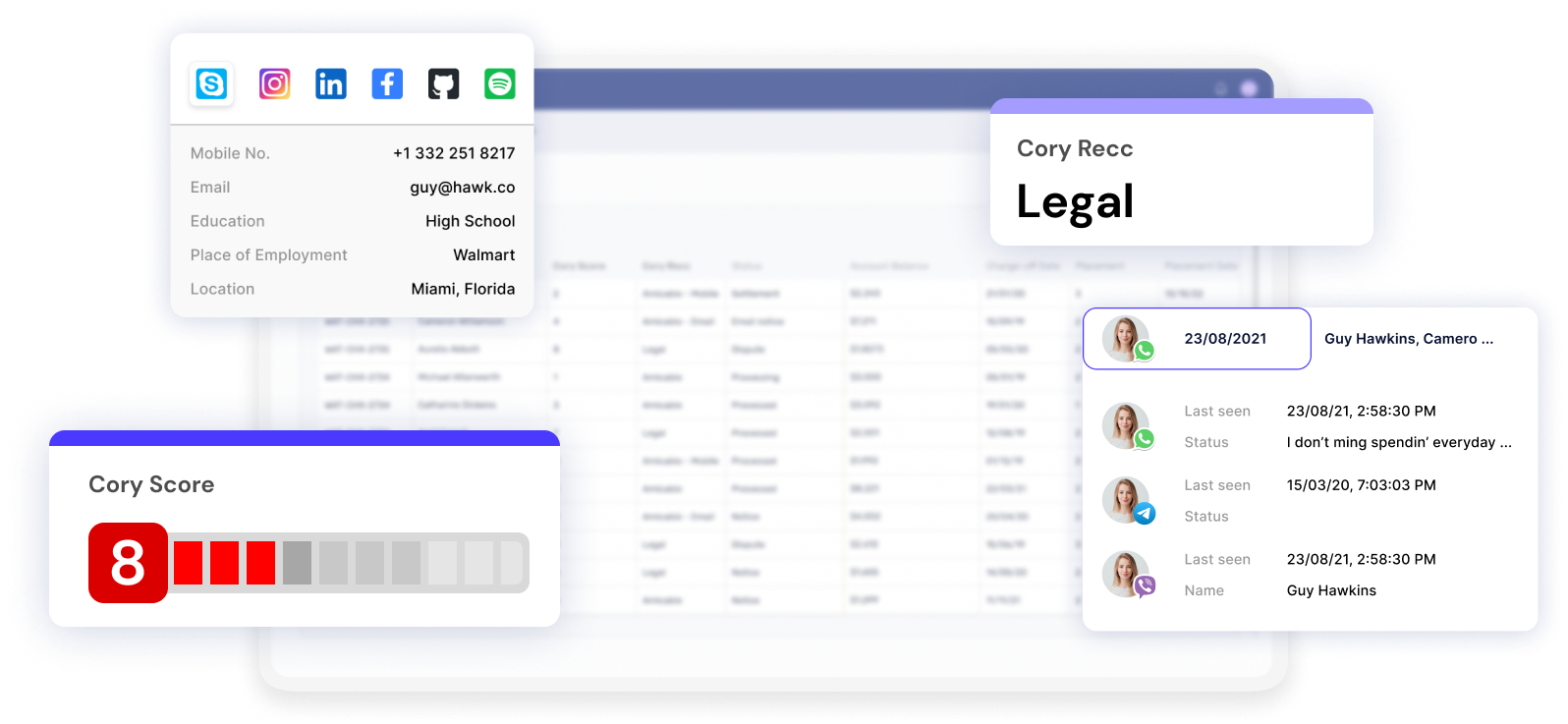

Contact data

Enhance customer engagement with updated mobile numbers, email addresses, social media profiles, and city-specific location information

Personal status

Assess risk levels and make informed decisions with vital status (deceased), bankruptcy and incarceration data

Employment & education

Assess financial stability with data on customers' place of employment, workplace addresses, and education data

Next-of-kin data

Offer tailored services and products with a better understanding of a family's financial dynamics

Dynamic credit scores

Evaluate receivables on a line-by-line basis to identify and profile the most valuable accounts, then identify the best servicing strategy for each account

High risk signals

Discover live signals that potentially indicate risky activities, such as early mortality, criminal and more

The Leading Platform for Integrating Live Data into Financial Services

Our platform caters to the financial services sector, including Banks, Life and Pension organizations, Asset Managers, and Financial Mutuals.

-

Consumer credit

-

Insurance underwriting

-

Pensions management

4.8% lift in collections

Banks, funds, and servicers use our platform to improve liquidation of consumer receivables.

Heka was deployed to a US debt fund-servicer. The platform evaluated each loan, generated tailored servicing strategy, and sourced missing consumer data.

0.82% prevention of high-risk candidates from approval

Insurance companies use Heka's platform to add a unique layer of risk signals to their underwriting processes.

Israel’s top insurance firm incorporated Heka into its life insurance underwriting, identifying high-risk applicants and optimizing risk management. Heka’s technology is now implemented across multiple underwriting departments.

Contact restored with 15% more members

Pension funds turn to Heka to augment their legacy records and solve unclaimed entitlements.

A leading UK pension scheme with AUM of £1B+ engaged Heka to determine the status of their uncontactable members, after other solutions only solved 5% of cases. Heka’s solutions are now being rolled out to their affiliated pension schemes.

Need clarification?

What is T2D3?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Can I use T2D3 on my phone?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Can I change my plan later?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

What is so great about the Pro plan?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.